Boost Your Business with Amazon VAT Number Invoice

Welcome to the world of AMZITO! Here, we understand the importance of running a successful business, and we are here to guide you every step of the way. In today's competitive market, utilizing every available resource is crucial to stay ahead. One such resource that can significantly benefit your business is the Amazon VAT Number Invoice. In this article, we will explore the advantages of the Amazon VAT Number Invoice and how it can contribute to the growth of your business.

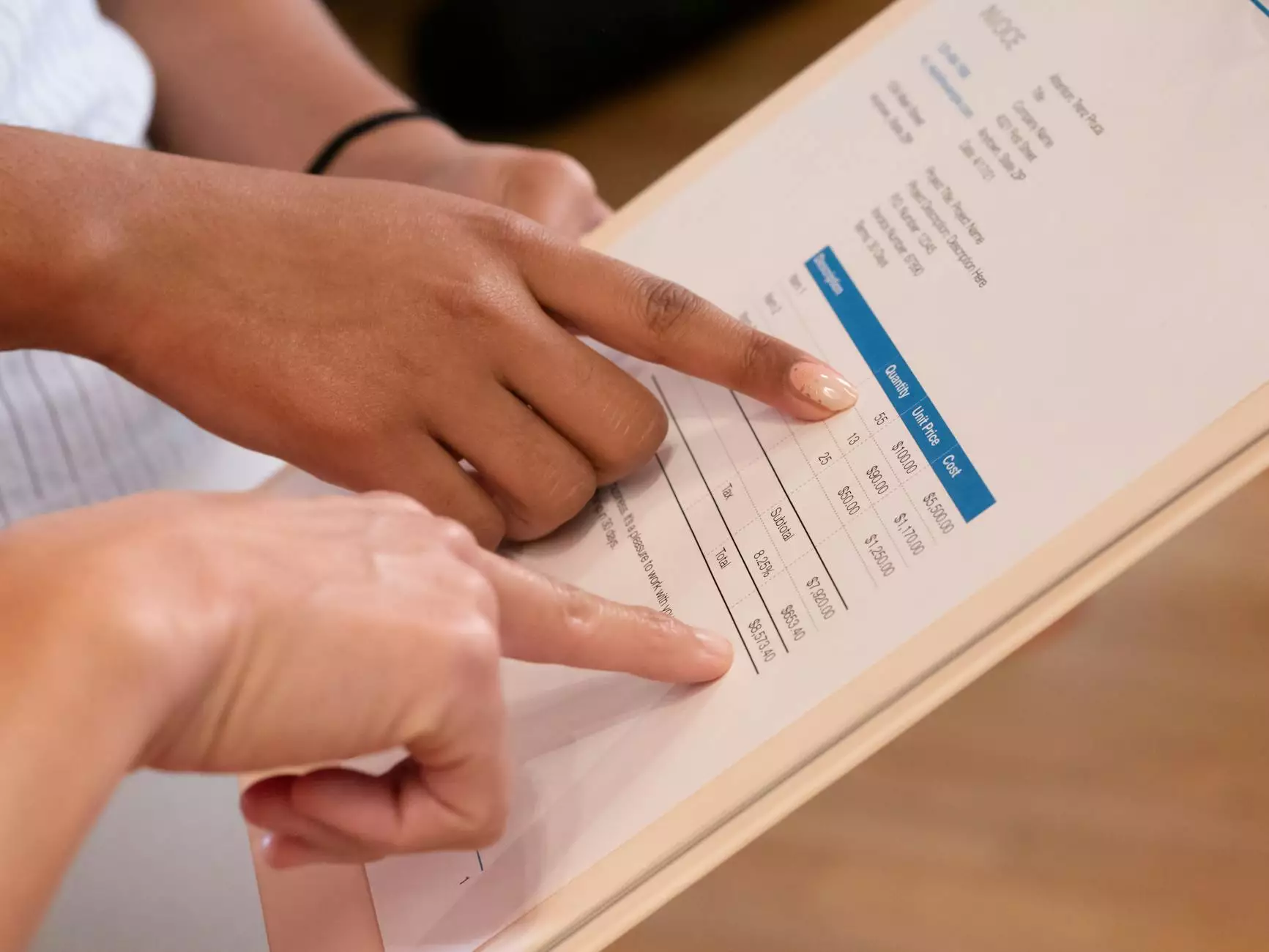

The Power of Amazon VAT Number Invoice

Amazon VAT Number Invoice is a valuable tool that enables businesses to simplify their accounting processes and streamline their operations. It allows you to reclaim VAT effectively, increase your profit margins, and minimize potential risks and accounting errors. By opting for the Amazon VAT Number Invoice, you gain access to a host of benefits that can amplify your business growth.

Improved Financial Management

One of the key advantages of adopting the Amazon VAT Number Invoice for your business is enhanced financial management. The detailed invoices provided by Amazon allow you to track your expenses, analyze your sales, and gain valuable insights into your business's financial health. With this information at your fingertips, you can make informed decisions and strategize for future growth.

Reduced Administrative Burden

Running a business involves managing various administrative tasks, including bookkeeping, accounting, and tax compliance. The Amazon VAT Number Invoice simplifies these processes, reducing the administrative burden on your team. By automating VAT calculations and generating accurate invoices, you save time and resources, allowing you to focus on core business activities.

Better VAT Compliance

Compliance with VAT regulations is essential for any business. With the Amazon VAT Number Invoice, you can rest assured that your business adheres to the necessary VAT compliance standards. The system ensures the accurate calculation and recording of VAT, eliminating the risk of errors or non-compliance.

Increased Credibility and Trust

Displaying your VAT number on invoices adds credibility and trust to your brand. Customers and business partners perceive VAT-registered companies as more professional and reliable. By including the Amazon VAT Number Invoice in your business process, you showcase your commitment to transparency and compliance.

Connect with the Best Experts in Healthcare

At AMZITO, we believe that partnering with professionals can take your business to the next level. In the Doctors, Health & Medical, and Nutritionists categories on AMZITO, you can find a wide range of experts who can offer valuable insights and support to grow your business. Whether you need doctors, health and medical specialists, or nutritionists, our platform connects you with the best in the industry.

The Path to Success

Now that you understand the benefits of the Amazon VAT Number Invoice and the expertise available at AMZITO, it's time to take action and boost your business. By integrating the Amazon VAT Number Invoice into your operations, you can enhance your financial management, reduce administrative burdens, ensure VAT compliance, and establish credibility among your customers and partners.

Visit AMZITO today and explore the endless possibilities for your business growth. Let us support you in making your entrepreneurial dreams a reality.

Conclusion

Utilizing resources like the Amazon VAT Number Invoice and partnering with experts from AMZITO can set your business on the path to success. Embrace the power of improved financial management, reduced administrative burdens, better VAT compliance, and increased credibility. Take the first step towards a thriving business and experience the difference today!